China has long been recognized as the “world’s factory,” producing everything from toys and textiles to smartphones and laptops. However, the nation’s industrial ambitions have expanded far beyond consumer goods. In recent years, China’s auto exports—especially in the electric vehicle (EV) segment—have skyrocketed, marking a historic transformation in the global automotive landscape.

According to the latest data from the China Passenger Car Association (CPCA), the country’s auto exports maintained a strong upward trend through the first seven months of 2025. With Chery holding its leading position and BYD accelerating rapidly, Chinese automakers are reshaping global market dynamics.

Chery Holds the Top Spot – Steady and Strong

In 2024, Chery ranked as China’s top car exporter, with an impressive 1,144,588 vehicles shipped overseas, representing a 21.4% year-on-year increase. That marked the 22nd consecutive year that Chery led all Chinese automakers in exports.

The momentum has continued into 2025. During the first seven months, Chery’s export volume reached 662,903 units, a 6.9% growth year-over-year. Analysts predict that if this pace continues, Chery could exceed 1.2 million exports by year’s end, solidifying its role as the leader in China’s auto exports.

This success is driven by Chery’s balanced strategy: affordable pricing, strong quality control, and a growing lineup of electric vehicles (EVs) that appeal to both emerging and developed markets.

BYD: Explosive Growth and Global Domination

If Chery represents stability, BYD embodies momentum. In the same seven-month period of 2025, BYD exported 521,462 vehicles, soaring 123.4% year-on-year—more than doubling its previous record.

The company’s global expansion has been remarkable. In the first quarter of 2025, BYD became the best-selling car brand in Hong Kong and Singapore, and the top EV brand in Brazil, Italy, Thailand, and Australia. In the UK, BYD’s sales recorded the highest growth both quarter-over-quarter and year-over-year.

Such performance underscores BYD’s position as a serious global challenger to Tesla. With its full-stack approach—covering batteries, chips, and vehicle platforms—BYD is increasingly seen as a frontrunner in the global electric vehicle (EV) revolution.

SAIC Faces Challenges, While Geely Gains Ground

Europe remains a critical battleground for Chinese automakers, despite rising trade tensions. In 2023, China surpassed Japan to become the world’s largest car exporter, with 4.91 million units shipped—including 482,000 electric cars sent to the EU, accounting for 45.1% of total EV exports.

SAIC Motor was the biggest contributor in 2023, exporting 242,831 vehicles to Europe. However, in 2025, EU-imposed tariffs targeting Chinese EVs have hurt SAIC’s performance. Between January and July, SAIC’s export volume fell 11.7% to 261,256 units.

Meanwhile, Geely is catching up fast. Over the same period, Geely exported 218,209 vehicles, up 3% year-over-year. Though still behind SAIC in Europe, Geely’s global strategy—anchored by brands like Lynk & Co, Zeekr, and Volvo—shows strong momentum. Analysts believe Geely could soon climb into the top three among China’s auto exporters.

Great Wall Motors Stays Competitive, Tesla Slides

Great Wall Motors (GWM), known for its SUVs and pickup trucks, continues to perform solidly despite market headwinds. From January to July 2025, GWM exported 203,406 vehicles, a slight 4.2% decline year-on-year. The company maintains healthy margins per vehicle, reflecting its focus on brand value and quality over pure volume.

In contrast, Tesla’s exports from China fell sharply. Its Shanghai Gigafactory shipped 128,333 units during the same period—a 27.2% year-on-year drop. Tesla’s European registration figures also plummeted: down 41.6% in July alone, and 34.3% for the first seven months of 2025.

Industry analysts attribute this to growing local competition from BYD and Volkswagen, as well as consumer backlash and shrinking incentives. Tesla’s valuation now seems increasingly disconnected from its fundamentals, raising concerns about its future market share in Europe.

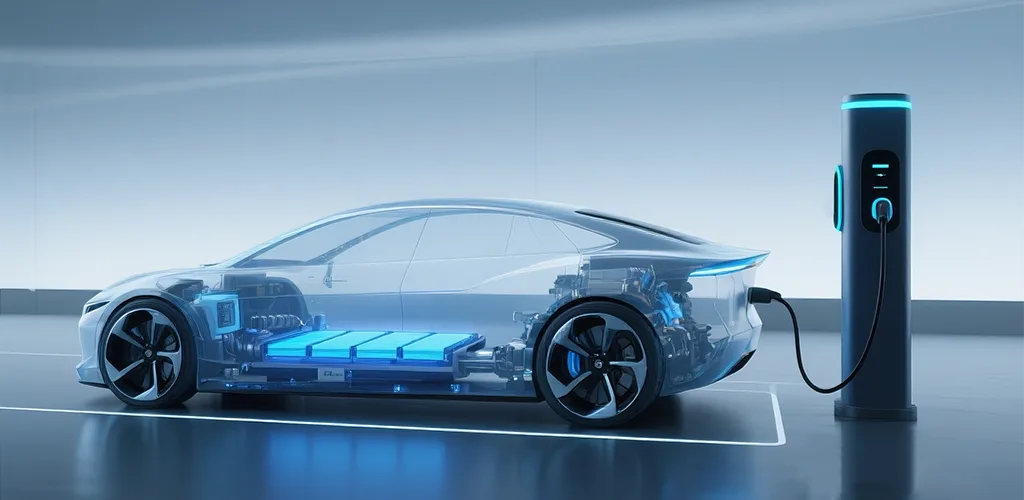

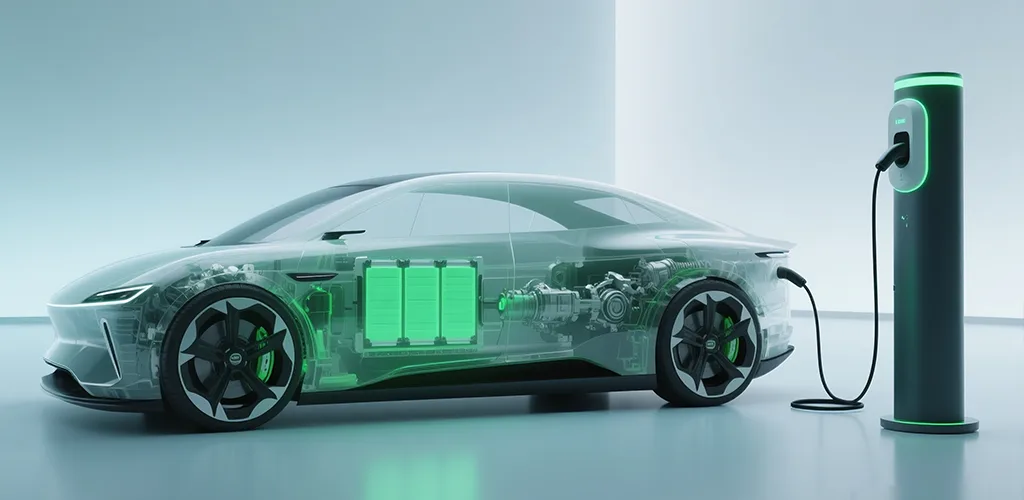

China’s Auto Industry: From Manufacturing to Global Innovation

The rapid ascent of China’s auto exports signals more than economic growth—it marks a shift in global industrial power. Chinese automakers have moved beyond being contract manufacturers to becoming technology innovators, leveraging electric powertrains, battery efficiency, and intelligent software systems.

Electric vehicles (EVs) are the driving force behind this transformation, now accounting for more than 60% of China’s global vehicle exports. The expansion into developed markets like Europe and Australia showcases not just competitive pricing, but also improved quality and design that appeal to international consumers.